Our children, born in the early 1980’s, appear to be among the last to be able to purchase homes. The current state is a nightmare. Entrepreneurs all over America, have invested in houses in order to rent them out. Rent in our area is about $1400.00 a month for a three bedroom home. When people pay that kind of a ridiculous rate, thy will never build up equity to purchase a home in the future! They are locked in! I am looking at a car I may purchase and it is more expensive than the four level new house that my parents bought in the late 1960’s! This generation, for the most part, will never be able to afford a house.

Sad but true, Pastor Steve <><

Breaking News Updates – May 02, 2024

| American Dream Replaced With American Nightmare: Renting For Life |

| BY TYLER DURDEN/ACTIVIST POST MAY 02, 2024 |

| For at least 40% of Americans – up from 27% just two years ago – the American Dream is dead and buried and has been replaced with the American nightmare: renting for life. |

And here’s why: according to a new survey from Clever Real Estate, a St. Louis-based real estate company, thanks to the galloping housing inflation, the median-priced home in the U.S. now costs $332,494, with NAR and Census Bureau data reporting that the median Existing and New Home sale price has risen to $393,500 and $430,700…

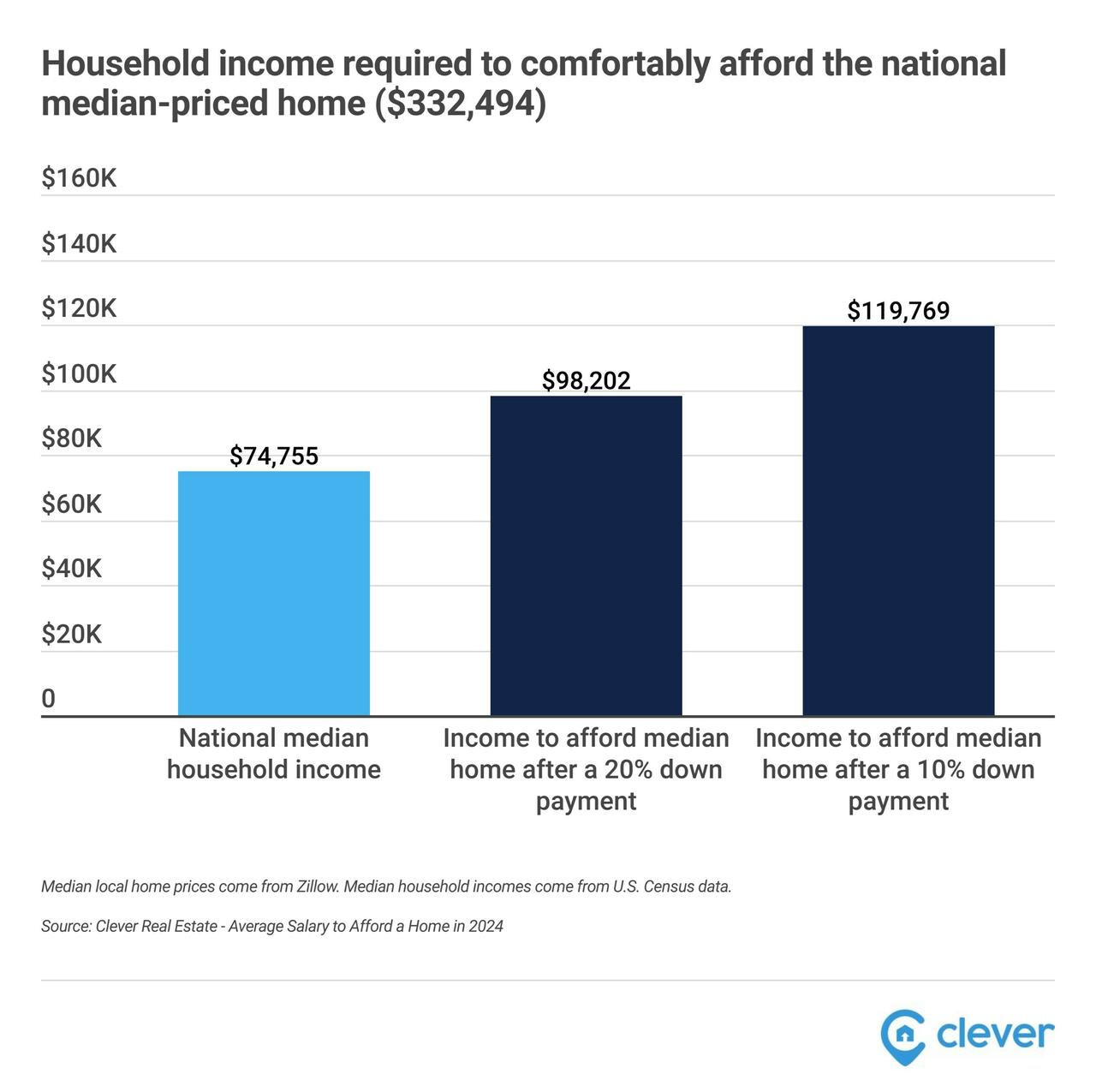

… meaning prospective buyers need an annual income of at least $119,769 to afford it with a 10% down payment.

That’s about $45,000 more than the typical household earns annually ($74,755). Even with a 20% down payment, home buyers would need to earn at least $98,202, still well above the typical salary.

The last year that the median buyer put down 20% was 1989, according to data from the National Association of Realtors (NAR). Today, the median buyer puts down just 15% of a home’s purchase price.

The median U.S. income earner ($74,755) with 10% down could only afford a home that costs $207,529 — 38% less than the current median-priced home.

A median-income family aiming to afford a median-priced home would need a hefty 45% down payment, or mortgage rates would need to drop from the current rate of 7.2% to 4% to make it work.

Even with a savings rate of $1,000 each month, it would take a household five and a half years to amass the $66,500 needed for a 20% down payment on a home priced at the median of $332,494.

As it stands, 61% of Americans find themselves priced out of the market even with a 20% down payment.

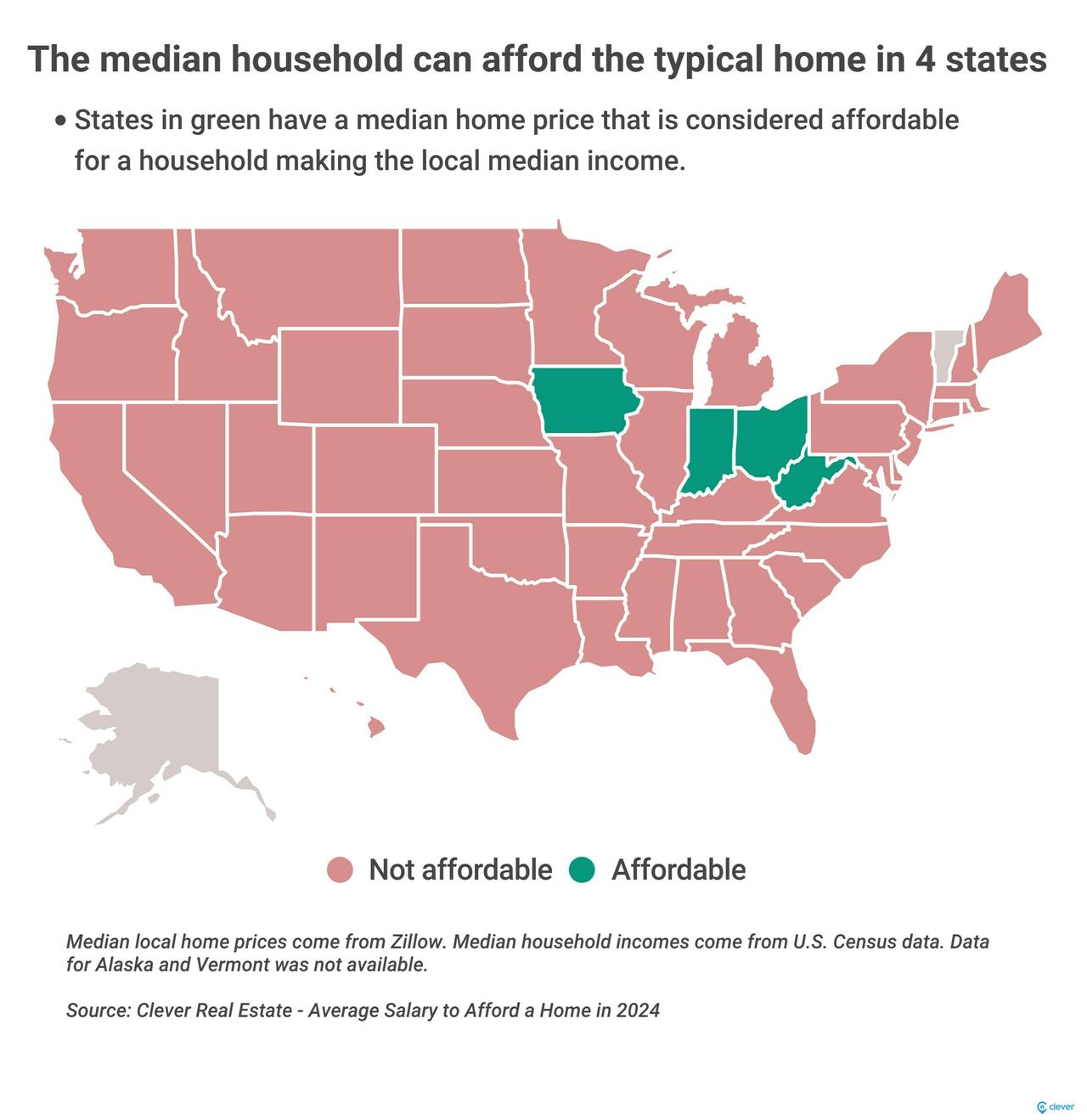

The median home is affordable for median earners in just four states (West Virginia, Ohio, Iowa, and Indiana)…

… and only six of the 50 largest metro areas:

Pittsburgh, PA

Cleveland, OH

St. Louis, MO

Memphis, TN

Indianapolis, IN

Birmingham, AL

Unsurprisingly, Los Angeles is the least affordable city, where buyers need an income of a whopping $249,471 to comfortably afford a median-priced home — nearly three times the actual median income of $87,743.

Originally published at Activist Post